FAQs

You have questions, we have answers.

-

A checking account is the most basic type of deposit account. It is used for the normal operations of your daily life. You deposit money into the account, and your funds are easily accessible using either traditional paper checks or more commonly, a debit card tied to the account. At Texas First Bank, we take checking accounts a step further by offering high-interest and cash-back rewards checking accounts with no monthly maintenance fees or minimum balance requirement.

Other benefits of Texas First Checking accounts include:

a. Unlimited Transactions

b. Easy Set Up for Automatic Bill Payments

c. Free Budgeting Tools

-

To open a personal bank account, you must be 18 years of age and a US citizen living in Texas.

During the process, you will need:

- A valid, government-issued ID (driver’s license, passport, state-issued ID card)

- Your personal information, including physical address, phone, DOB, and SSN

- A minimum opening deposit in the form of cash or check (minimum amount varies by product, but is usually $50)

If you are not 18, you will probably need someone to co-own the account, usually a parent or guardian. They will need to provide their ID and personal information, as well.

-

Yes, you may open a Texas First Bank checking account using our online account opening tool. Please be sure to have your information and documentation to ensure a smooth process. If you desire a co-signer, they will also need to be present at the time of opening online.

-

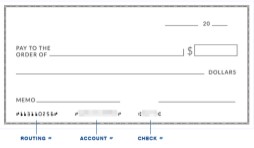

Texas First Bank’s routing number is 113110256. To find your account number, you can reference your checks or view them in online banking by clicking on “Details” within your transaction history.

-

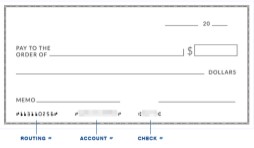

Writing a check does not have to be complicated. The account holder’s name and contact information, check number, bank routing number, and account number are preprinted on each check. The six blanks are what the accountholder completes in just a few easy steps:

- Date the check with month, date, and year. Use the current date, as backdating and future dating can result in various issues.

- Complete the “Pay to the Order of” line with the recipient’s name. Check the spelling so the check isn’t returned.

- Write the dollar amount in numbers, including both dollars and cents, within the small box to the right of the recipient information. One hundred dollars should be written as “100.00”, for example.

- Write the dollar amount in words, including cents as fractions. In the $100 example, it should be written as, “one hundred and 00/100”. When writing out the amount, begin as far left as possible and draw a straight line through any blank space to the right of your amount to help prevent fraud.

- Complete the Memo line with information about what the check is for and any relevant information you may need for your payment records.

- Sign the check in the bottom right corner.

-

Texas First Bank offers high-interest and cash-back reward checking accounts, along with a basic, no-frills InControl Checking account and a Five Star Checking account. Learn more and compare the accounts on our Personal Checking page.

-

Direct deposit is a service in which you may set up recurring income to deposit automatically into a Texas First Bank checking or savings account. This could be your paycheck, Social Security, or retirement distributions, along with any VA benefits or dividend payments.

To set up direct deposit, start by requesting a printed or online direct deposit form from your employer or whichever organization from which you wish to send the month to TFB. Complete this information using the bank’s mailing address, routing number, and your account number.

Attach a voided check or a deposit slip to the form, and submit. Confirm in the coming weeks that it was properly set up.

-

You can order checks by contacting your local banking center or selecting “Check Reorder” under “Services” in your TFB Mobile App or Online Banking.

-

You can begin using your account as soon as your initial deposit clears. If you made a cash deposit, this is usually instant. If you paid with a check, it may take a few days. Your debit card may be printed on-site or you may request one be mailed to you, along with your checks.